Services & Expertise

CHRONOS is an independent, Luxembourg based Investment Management Company, which manages, advice and develops companies with support of private capital.

The company is focusing on Clients investing in all Asset Classes with different Risk Profiles Clients and supporting the portfolio companies growth with a lot of sector experience in Energy – Digital Infrastructure – Transport combined with Technology during all different Development phases.

CHRONOS is a full service provider for Investors in Luxembourg, from Dealsourcing, Asset Management, value creation and at the same time Holding vehicle for Co-Investments with our clients to align interest or for strategic partnerships. (e.g. R3AMP).

1. Investment Advisory

Advice and Services

Along the development of investment opportunities, transactions or projects

Dealsourcing & Bid Support

Asset Management & Value Creation

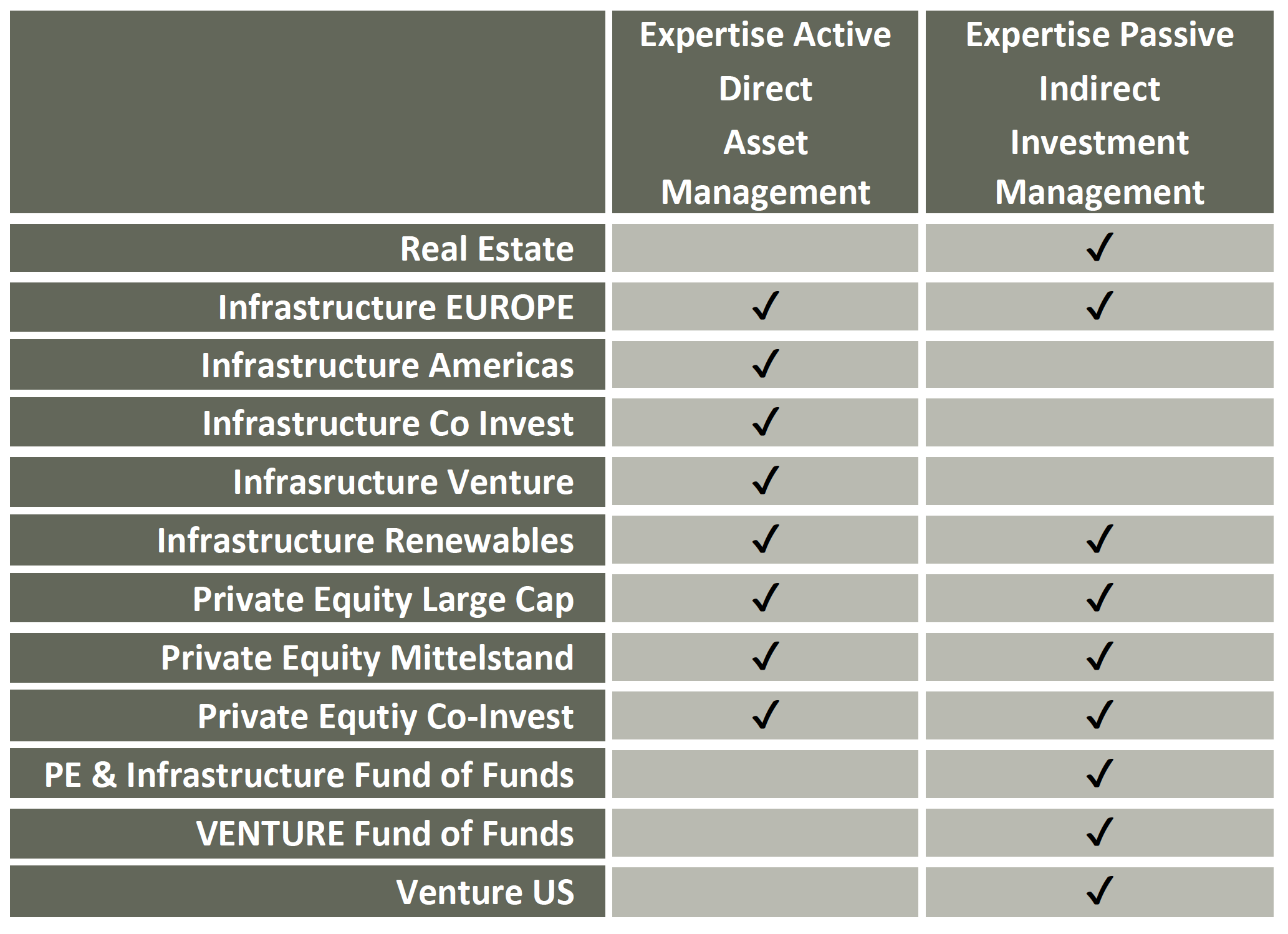

2. Investment Management

Strategic Investment Advice

Mandates

Independent Board Seats

3. Investments (Strategic and Financial Investments)

Co-Investments with Clients

Medium size business